Answer:

$77.81

Step-by-step explanation:

We are given that West Side Corporation is expected to pay the following dividends over the next four years: $16, $12, $11, and $7.50.

Required rate - 16%

Growth rate = 6%

We are supposed to find the current share price

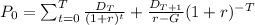

Formula :

D = Dividends

t = time

r = required rate

G= Growth rate

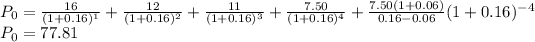

Substitute the values in formula :