Answer:

a) sales revenue 75,760

cost of good sold 51,000

gross profit: 24,760

b)

LESSOR ENTRIES:

lease receivable 69,260 debit

cash 6,500 debit

sales revenue 75,760 credit

--to record sale on lease--

cost of good sold 51,000 debit

Inventory 51,000 credit

--to record cost--

LESEE ENTRIES:

equipment 75,760 debit

lease liability 69,260 credit

cash 6,500 credit

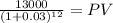

Lease Schedule:

![\left[\begin{array}{cccccc}Time&Beg&Cuota&Interest&Amort&Ending\\0&75760&6500&&6500&69260\\1&69260&6500&2078&4422&64838\\2&64838&6500&1945&4555&60283\\3&60283&6500&1808&4692&55591\\4&55591&6500&1668&4832&50759\\5&50759&6500&1523&4977&45782\\6&45782&6500&1373&5127&40655\\7&40655&6500&1220&5280&35375\\8&35375&6500&1061&5439&29936\\9&29936&6500&898&5602&24334\\10&24334&6500&730&5770&18564\\11&18564&6500&557&5943&12621\\12&12621&13000&379&12621&0\\\end{array}\right]](https://img.qammunity.org/2021/formulas/business/college/6my673ahdh9grwa8qe957jygbxn9s3j2tq.png)

December 31st, 2021 (1st payment)

LESEE ENTRIES:

lease liability 4,422 debit

interest expense 2,078 debit

cash 6,500 credit

--to record payment--

depreciation expense 3,547.5 debit

acc depreciation 3,547.5 credit

--to record depreciation--

LESSOR ENTRIES:

cash 6,500 debit

lease receivables 4,422 credit

interest revenue 2,078 credit

e) option exercised:

LESEE ENTRIES:

lease liability 12,621 debit

interest expense 379 debit

cash 13,000 credit

--to record purchase option--

LESSOR ENTRIES:

cash 13,000 debit

lease receivables 12,621 credit

interest revenue 379 credit

--to record purchase option--

Explanation:

We solve for the present value of the lease:

Present Value of Annuity-due

C $6,500

time 12

rate 0.03

PV $66,642.0567

+ 13,000 purchase option on June 2024:

PRESENT VALUE OF LUMP SUM

Maturity 13,000.00

time 12.00

rate 0.03

PV 9,117.94

Total lease receivables: 66,642.06 + 9,117.94 = 75,760

a) sales revenue 75,760

cost of good sold 51,000

gross profit: 24,760

d) depreciation on equipment:

(75,760 - 19,000) / 4 year = 14,190 per year

we divide by four as only a quarter of the year past:

14,190 / 4 quarter = 3,547.5

It is the lesee which does the depreicaiton as the Truck possesion belong to it.