Answer:

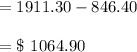

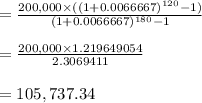

The answer is "$1064.90".

Step-by-step explanation:

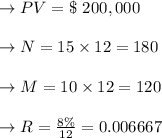

Mortgage balance after 10 years Only at end of the 10th year, we must first calculate the amount of credit outstanding.

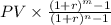

Amount repaid =

Amount of outstanding

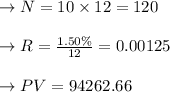

The balance of mortgage = $94262.66

Refinancing :

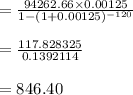

The monthly payment = 846.40