Answer:

--- FIFO

--- FIFO

-- LIFO

-- LIFO

Step-by-step explanation:

Solving (a):

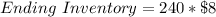

FIFO method

This means that the first items to be listed were sold out and only 240 of the last item is left

This implies that the following units were sold

340 units at $5; 440 units at $7 and (540 - 240) units at $8

So: We're left with

Solving (b):

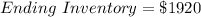

LIFO method

This means that the last items to be listed were sold out and only 240 of the fist item is left

This implies that the following units were sold

540 units at $8; 440 units at $7 and (340 - 240) units at $5

So: We're left with