Answer:

The monthly withdrawal will be of $ 7.823,24

Step-by-step explanation:

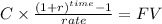

We solve for the future value of each investment:

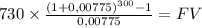

stock account:

C 730

time 300 (25 years x 12 month per year)

rate 0,00775 (9.3% among 12 months)

FV $860.498,28

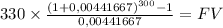

bond account:

C 330

time 300

rate (5.3% annual among 12 months) 0,004416667

FV $205.563,2522

now, we add them:

860498.28 + 205.563,25 = $1.066.061,53

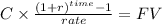

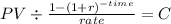

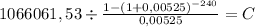

And last, solve for the monthly withdrawal of this sum:

PV $1.066.061,53

time 240 (20 years x 12 months)

rate 0,00525 (6.3% among 12 months)

C $ 7.823,244