Answer:

Total interest paid during the first year: $1,183.69

Step-by-step explanation:

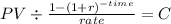

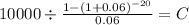

First, we need to know the installment amount:

PV 10,000.00

time 20

rate 0.06

C $ 871.85

now we calcualte the interest and amortization made in the first payment:

interest: 10,000 x 6% = 600

Amortization 871,85 - 600 = 271,85

Principal at second installment:

10,000 - 271.85 = 9,728.15

Interest 9,728.15 x 0.06 = 583,69

Total interest: 583,69 + 600 = 1.183,69