Answer:

Explanation:

So, we know that Jolene bought an initial $750.

We also know that the purchase is increasing at an average rate of 5 1/2 %or 5.5%. In other words, this is being compounded.

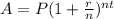

So, we can use the compound interest formula, which is:

Where A is the total amount, P is the principal value, r is the rate and n is the number of times compounded per year, and t is the amount of years.

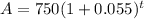

So, substitute 750 for P. 5 1/2% is the same as 5.5% or 0.055 (you move the decimal two places to the left and remove the percent symbol) so substitute this for r. Since it's increasing yearly, n is 1. So, our formula is:

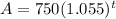

Add:

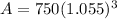

Since the stock was bought 3 years ago, the value now is t=3. So, substitute 3 for t and evaluate:

Evaluate. Use a calculator:

And we're done!