Answer:

$1807.94

Explanation:

Given that:

Annual income = $43047

Social security (FICA tax) = 4.2% of the gross wages

To find:

Social security paid = ?

Solution:

Social security (FICA tax) is calculated by finding the 4.2% of the Total Gross Annual income.

i.e. for the given value, the social security paid can be calculated as:

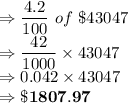

4.2% of $43047

Therefore, the Social Security paid is $1807.94.