Answer:

The Profit per option = $1.431

Step-by-step explanation:

Given that:

Current stock price S = $61

Exercise Strike price X = $55

Value of call option C = $5.28

Puts Costs = $0.56

risk-free rate = (1.1% × 3)/12

risk - free rate = 0.275%

If the put options are mispriced, what is the profit per option assuming no transaction costs

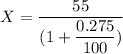

Present value of the strike price

X = $54.849

The formula that hold for the put option can be expressed as:

P = Present value of the strike price X + C - S

P = $(54.849 + 5.28 - 61)

P = $60.129 - $61

P = - $0.871

Thus, the put option = - $0.871

This implies that the Put option is out of cash since it is negative.

Now, The Profit per option = put costs - (- put option)

The Profit per option = 0.56 - ( - 0.871)

The Profit per option = $1.431