Answer:

The expected return on Bo's complete portfolio will be "10.32%".

Step-by-step explanation:

The given question is incomplete. Please find attachment of the complete question.

According to the question, the given values are:

Port's expected return,

T-bill's expected return,

Port's weight,

T-bill's weight,

Now,

The Bo's complete portfolio's expected return will be:

⇒

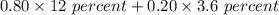

On substituting the given values, we get

⇒

⇒

Note: percent = %