Answer: 13%

Step-by-step explanation:

By substituting 20% of debt for debt yielding 8%, the company now has 20% financing from debt and 80% from equity.

The expected return on common stock after refinancing can be calculated by;

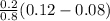

Return after refinancing = Return before refinancing +

(return before refinancing - Debt yield)

(return before refinancing - Debt yield)

= 12% +

= 13%