Answer:

all portfolios and individual securities.

Step-by-step explanation:

CAPM is an acronym for capital asset pricing model. The capital asset pricing model (CAPM) can be defined as a model or formula that can be used to calculate an investment risk and the expected return on an investment (assets).

Simply stated, the capital asset pricing model gives an investor the relationship between the risk of investing in securities and its expected returns. Thus, it assists investors in making well-informed decisions about whether or not to add to a portfolio.

Additionally, the expected return could be either a profit or loss depending on the risks associated with the securities.

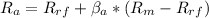

Mathematically, the CAPM is given by this formula;

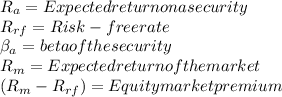

Where;

In a nutshell, it is important to note that the capital asset pricing model (CAPM) applies to all portfolios and individual securities.