Answer:

The answer to this question can be defined as follows:

Step-by-step explanation:

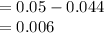

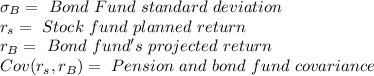

The risk-free rate of T-bill is (r f), which is 4.4% = 0.044. The fund for stocks (S) An expected 14% = 0.14 return and the value of the standard deviation is 34% = 0.34. The Announcement fund of (B) and the estimated 5% = 0.05 return, with a standard deviation 28% = 0.28 .

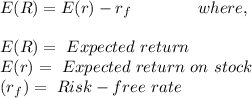

following are the formula for the equation is:

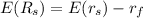

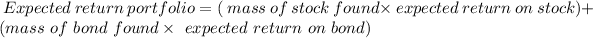

Using the formula to measure the projected return for bond and stock fund:

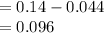

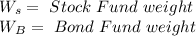

Measure mass with optimized risk for stock index fund (S) and Bond Fund (B), Introduce to investment as follows:

![W_s=(E(R_s)\sigma_(B)^2-E(R_B) Cov(r_s,r_s))/(E(R_s)\sigma_B^2+E(R_B)\sigma_s^2-[E(R_s)+E(R_s)]Cov(r_s,r_s))](https://img.qammunity.org/2021/formulas/business/college/5e3et91iqir1jzizyat03tpyszozn4xlvo.png)

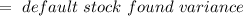

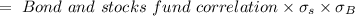

Measure the portfolio and bond fund covariance according to:

Bond and equity fund covariance

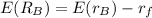

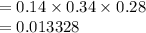

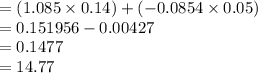

Measure the mass of the stock and bond fund as follows:

![W_s=(E(R_s)\sigma_(B)^2-E(R_B) Cov(r_s,r_s))/(E(R_s)\sigma_B^2+E(R_B)\sigma_s^2-[E(R_s)+E(R_s)]Cov(r_s,r_s))](https://img.qammunity.org/2021/formulas/business/college/5e3et91iqir1jzizyat03tpyszozn4xlvo.png)

![=(0.096 * 0.28^2-0.006* 0.013328)/(0.096 * 0.28^2+0.006* 0.34^2-[0.096+0.006]* 0.013328)](https://img.qammunity.org/2021/formulas/business/college/byyfr91amssd3m127fe1jd7uuk70yi80ae.png)

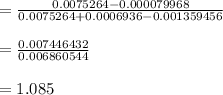

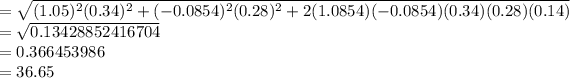

The correspondence(p) here is 0.14. Calculate the norm for the maximum risky as follows:

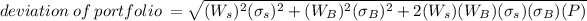

The standard deviation for the optimal risky portfolio is 36.65%

The optimal risk portfolio is 14.77%