Answer:

$5,412,000

Step-by-step explanation:

Given:

Long-term debt (bonds, at par):$10,000,000

Preferred stock :2,000,000

Common stock ($10 par): 10,000,000

Retained earnings: 4,000,000

Total debt and equity :$26,000,000

Coupon rate = 4%(semi annually)

Par value = $1000

YTM = 12%

Required:

Find the current market value of the firm's debt.

Find the bond price:

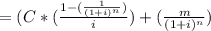

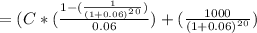

Bond price

Bond price = $541.20

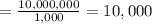

Find number of bonds:

Number of bonds

Now, to find the current market value of the firm's debt, use:

Current market value of debt = number of bonds × bond price

= 10,000 × 541.20

= $5,412,000

Current market value of the firm's debt = $5,412,000