Answer:

The difference between the riskier and less riskier stock is 13.2 percent.

Step-by-step explanation:

Given that the stock R has the Beta = 2.5

The stock S has the beta = 0.85

The required return on the average stock = 12%

Given risk free rate of return = 4%

Now calculate the required return by using the below formula:

Ke = Rf + B (Rm - Rf)

Rf = risk free rate of return

B = beta

Rm = market rate of return

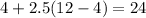

Required return on riskier stock =

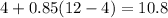

Required return on less risky stock =

Now the difference between the both risk = 24 % - 10.8% = 13.2%