Answer:

The stock price is 38.63

Step-by-step explanation:

We use the gordon model to calculate the horizon value and with htat the value of the stock:

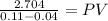

D1 = 2.60 x 1.04 = 2.704

rate of return 11% = 0.11

grow rate = 4% = 0.04

P0 = 38.62857143

The taxes should be ignored as the gordon model do not include them in the calculations