Answer:

The present value of these acquired tax loss is $15.81 billion

Step-by-step explanation:

We can shield $ 10 billion for the next 7 years and $4 billion in the 8th year

Given the tax rate = 30%

Years 1 - 7, tax savings = $ 3 billion

Year 8, tax savings = $1.2 billion

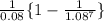

Present value (PV) = 3 ×

+

+

= 3 × 12.5(1-0.58) + 0.648

= 3 × 5.25 + 0.648

= 15.75 + 0.648

= $ 15.81 billion

Therefore, the present value of these acquired tax loss is $15.81 billion