Answer:

Therefore, the UK pound is at a discount against the U.S. dollar, because it is worth less in the One-month forward market than in the spot market.

Step-by-step explanation:

Given:

Selling price = $1.5137

Spot price = $1.5139

We'll calculate how much pound is worth in the forward market.

We'll use the formula:

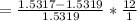

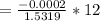

(selling - spot price )/spot price * 12/months of contract

= -0.0015853

Therefore, the UK pound is at a discount against the U.S. dollar, because it is worth less in the One-month forward market than in the spot market.