Answer:

Step-by-step explanation:

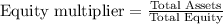

Equity multiplier is one of the financial leverage ratios, which measures the amount of a company's asset that are financed by the shareholder by comparing total assets with total shareholder's equity

Determine the amount of equity multiplier

Equity multiplier = 1 + Debt to equity ratio

= 1 + 0.65

= 1.65

Hence, the amount of equity multiplier is 1.65

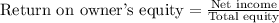

Determine the amount of return on equity

Return on equity = Return on assets * Equity multiplier

= 0.082 * 1.65

= 13.53%

Hence, the Return on equity is 13.53%

Determine the amount of Net income

Net income = Return on equity * Total equity

= 13.53% * $515,000

= $69,679.50

Hence, the amount of net income is $69,679.50