Answer:

C. $5,509.50

Explanation:

The computation of the estimated total tax due in case of taxable income for $43,500 is shown below:

Since in the question the income brackets and based on the income the different tax is to be charged

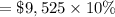

For $9,525, the 10% tax is charged i.e

= $952.50

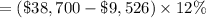

Upto $38,700, the 12% tax is charged i.e

= $3,500.88

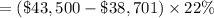

The remaining amount left is

= $1,055.78

Now the total tax due is

= $952.50 + $3,500.88 + $1,055.78

= $5,509.16 approx i.e $5,509.50