Answer:

C. It will increase by about 0.6%

Step-by-step explanation:

Since, the effective interest rate is,

Where, i is the stated interest rate,

n is the number of compounding periods,

Here, i = 11.28 % = 0.1128,

n = 365 ( 1 year = 365 days ),

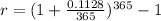

Hence, the effective interest rate would be,

=0.119388521952

Now, the changes in effective interest rate = Effective interest rate - Stated interest rate

= 0.119388521952 - 0.1128

= 0.006588521952 ≈ 0.006 = 0.6 %

Hence, It will increased by about 0.6 %,

Option A is correct.

Hope this helps :)