Answer:

Option(d) is the correct answer to the given question.

Step-by-step explanation:

Earnings per share shows the investors that how much of a company's net profit has been earmarked for each preferred share. The main objective of earning per share is order to provide a more correct image of the profits in the corporations with a complicated financial structure it also disclose both simple earning per share and refined earning per share .

The earning per share can be calculated by the given formula that is given below

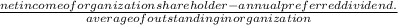

Earning per share =

So on deducted annual preferred dividend in the numerator we get earning per share that's why option(d) is correct .