Answer:

$20,086.35

Explanation:

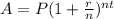

To calculate the maturity value by compound interest, we will use the formula

where,

A = Maturity amount

P = Principal amount = $10,000

r = rate of interest = 4.65% = 0.0465

n = number of compounding periods = 365

t = time in years = 15 years

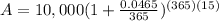

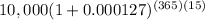

Now substituting the values,

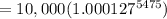

=

= 10,000(2.008635)

= 20086.353758 ≈ $20,086.35

The final value of your investment would be $20,086.35.