Answer:

$3.87

Step-by-step explanation:

Given the information:

- Dividend of $ 1.55

- Cost of capital = 9%

- Selling price =$64

the expected capital gain from the sale of this stock at the end of the coming year can be calculated :

= Expected selling price after a year -the stock current value

We need to find the stock current value

The current stock value is given by:

The Cost of equity = the change in market price + dividend

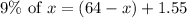

<=>

<=> 1.09x = $65.55

<=> x = $60.13

=> the expected capital gain = $64 - $60.13 = $3.87