Answer:

before taxes:

WACC 8.74959%

after a 21% tax-rate:

WACC 7.23587%

Step-by-step explanation:

Equity: 60,000 x $45.90 = 2,754,000

Liabilities: 1,900,000 + 22,000 x 925 = 22,250,000

Value: 25,004,000

We solve for weights:

Ew = 2,754,000 / 25,004,000 = 0,1101423772196449

Lw = 22,250,000 / 25,004,000 = 0,8898576227803551

Cost of debt will be the market value rate of the bond That is the rate at which the future coupon payment and maturity matches the market price of the bond

we solve this using excel goal seek:

C 35.00

time 20

rate 0.040545327

PV $473.3728

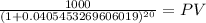

Maturity $1,000.00

time 20.00

rate 0.04055

PV 451.6270

PV c $473.3728

PV m $451.6270

Total $924.9998

a semiannual rate of 0.04055 is the market rate thus, cost of debt is

0.04055 x 2 = 0.081

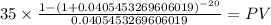

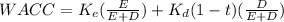

Now we can solve for the WACC without taxes:

Ke 0.14000

Equity weight 0.1101

Kd 0.081

Debt Weight 0.8899

t 0

WACC 8.74959%

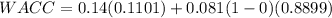

wiht taxes of 21%

t 0.21

WACC 7.23587%