Answer:

(a) 10.20 s (nearest hundredth)

(b) 127.55 m (nearest hundredth)

(c) 883.70 m (nearest hundredth)

Step-by-step explanation:

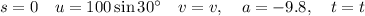

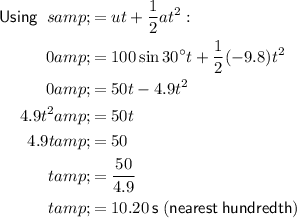

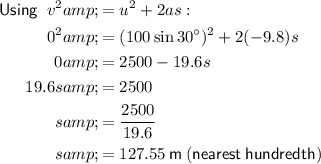

Part (a)

At the end of the projectile's flight, its vertical displacement will be zero.

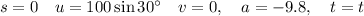

Resolving vertically, taking up as positive:

Part (b)

At the maximum height, vertical velocity will be zero.

Resolving vertically, taking up as positive:

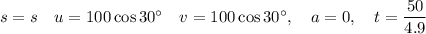

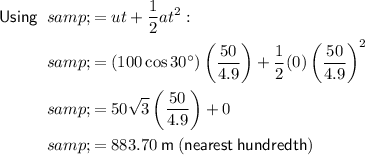

Part (c)

The horizontal velocity of a projectile is always constant, so u = v.

The horizontal component of acceleration is zero.

Resolving horizontally, taking right as positive (and using the value for t we found in part a):