Answer:

Since you would withdraw more money with the compound interest, you would choose the bank which uses compund interest.

Explanation:

Simple interest formula:

The simple interest formula is given by:

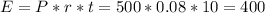

In which E are the earnings, P is the principal(the initial amount of money), r is the interest rate(yearly, as a decimal) and t is the time.

After t years, the total amount of money is:

.

.

Compound interest formula:

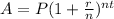

The compound interest formula is given by:

Where A is the amount of money, P is the principal(the initial sum of money), r is the interest rate(as a decimal value), n is the number of times that interest is compounded per unit t and t is the time the money is invested or borrowed for.

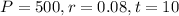

In this problem:

So

Simple interest:

In total:

Using simple interest, you would withdraw an amount of $900.

Compound interest

We use n = 1

You would withdraw $1079.86. Since you would withdraw more money with the compound interest, you would choose the bank which uses compund interest.