Answer:

95% confidence interval for the actual proportion of Meridian Township residents who are in favor of the tax increase is [0.5228 , 0.6972].

Explanation:

We are given that the Township Board of Meridian Township randomly surveyed a group of residents and found that 61% are in favor of the tax increase.

The estimated standard error of sample proportion is 0.0445.

Firstly, the pivotal quantity for 95% confidence interval for the population proportion is given by;

P.Q. =

~ N(0,1)

~ N(0,1)

where,

= sample proportion of residents in favor of the tax increase = 61%

= sample proportion of residents in favor of the tax increase = 61%

n = sample of criminals

p = population proportion

Here for constructing 99% confidence interval we have used One-sample z proportion test statistics.

The 95% confidence interval for the actual proportion of Meridian Township residents who are in favor of the tax increase is given by;

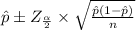

95% Confidence interval for p =

Here, Standard error =

= 0.0445

= 0.0445

And

= significance level

= significance level

So,

= 1.96

= 1.96

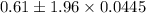

Hence, 95% Confidence interval for p =

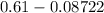

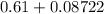

= [

,

,

]

]

= [0.5228 , 0.6972]

Therefore, 95% confidence interval for the actual proportion of Meridian Township residents who are in favor of the tax increase is [0.5228 , 0.6972].

Also, the upper bound for the 95% confidence interval is 0.6971.