Answer:

The probability that a person is guilty given that he or she denies the knowledge of the error is 0.6068.

Explanation:

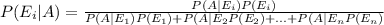

The Bayes' theorem states that the conditional probability of an event E

, belonging to the sample space S, given that another event A has already occurred is:

, belonging to the sample space S, given that another event A has already occurred is:

Denote the events as follows:

X = illegal deduction is filed

Y = knowledge of the error is denied.

The information given is:

P (Cheating) = 0.06

P (Actual error) = 0.03

P (Y|X) = 0.76

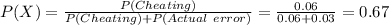

Compute the probability of X as follows:

The probability that a person who is not guilty will deny the knowledge of the error, is:

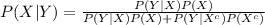

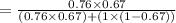

Compute the value of P (X|Y) as follows:

Thus, the probability that a person is guilty given that he or she denies the knowledge of the error is 0.6068.