Answer:

$93,940.85

Step-by-step explanation:

Adjusted present value is the sum of net present value of after tax cash flow and net present value of tax shield.

First compute after tax cash flow:

Cash inflow = $478,000

Cash cost = 68% of $478,000 = $325,040

Pre-tax profit = 478,000 - 325,040 = $152,960

Tax = 34 %

After tax cash flow = 152,960 (1 - 0.34) = $100,953.60

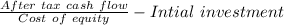

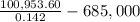

Net present value of after tax cash flow =

=

= $25,940.85

Present value of tax shield = Amount of debt × tax rate

= 200,000 × 0.34

= $68,000

Adjusted present value = 28,940.85 + 68,000

= $93,940.85