Answer:

Step-by-step explanation:

If the market return was known, our calculation would have been easier

Where W=Weight, S= Standard Deviation, P=Covariance

1= General Motors, 2= Microsoft and 3= Risk free Asset

It gets easier as

All Weights (W) are known, W1= 0.4, W2= 0.4 and W3= 0.2

S1 and S2 can be easily found out and S3 is zero (Standard Deviation of Risk Free Asset)

Covariance (P) of any stock with risk free asset is zero, so P23 and P13 are zero

We need S1, S2, P12

+As Beta of GM = 1.1 and Standard Deviation of Market = 0.2 and R2 of GM = 0.4

We can find S1 by the formula Beta=(Sd of Stock/Sd of Market) * RGM2

Standard Deviation of Gm (S1) = BetaGM * (Standard Deviation of Market / RGM2 )

= 1.1 * (0.2 / 0.4)

= 0.55

+As Beta of Microsoft = 0.8 and Standard Deviation of Market = 0.2 and R2 of Microsoft = 0.3

We can find S2 by the formula Beta=(Sd of Stock/Sd of Market) * RM2

Standard Deviation of Gm (S2) = BetaM * (Standard Deviation of Market / RM2 )

= 0.8 * (0.2 / 0.3)

= 0.5333333

+As Correlation between Microsoft and General Motors is given as 0.3 and S1and S2 are known from above,

Covariance of General Motors and Microsoft (P12) can be found out from the formula

Corelation 12 = Covariance 12/(Standard Deviation 1 * Standard Deviation2)

So Covariance of the Stocks P12 = Corelation12 * S1 * S2

= 0.3 * 0.55 * 0.533

= 0.087945 or 0.088

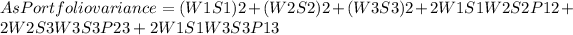

So Portfolio Variance = (W1S1)2+(W2S2)2++2W1S1W2S2P12

Note

[any term with S3 gets cancelled hence, omitted for easier comprehension]

= (0.4*0.55)2+(0.4*0.533)2+2(0.4)(0.55)(0.4)(0.533)(0.88)

= 0.0484 + 0.04545 + 0.008255

= 0.102105 or 0.102

= √0.102

= 0.3195 or 0.32