Answer:

option A is to be chosen because the net present value of cost is $1,216,986

Step-by-step explanation:

Company has to choose between 3 options:

We will calculate net present value of costs for each alternative to decide the best:

Option A:

Cost of Investment : $800,000

Annual Operating costs : $50,000 + $60,000 = $110,000

Discount rate 10%

Annuity factor at 10% for 5 Years

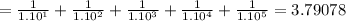

Now to get present value on $110,000 for 5 Years at 10% discount rate, we should multiply it by Annuity factor.

= $110,000 × 3.79078 = $416,986

Net present value of cost for Option A = $800,000 + $416,986 = $1,216,986

Option B:

Burner Cost: $200,000

Life = 5 Years

Annuity factor at 10% = 3.79078

Annual Coal Expenses: 8,000 tons at $40 per ton = $320,000

Annual Maintenance costs: $10,000

Net present value of annual costs = $330,000 × 3.79078 = $1,250,957

Net present value of cost for Option B = $200,000 + 1,250,957 = $1,450,957

Option C:

Current NOx emission level: 250 Tons

Required NOx emission level : 100 tons

Permits to be brought = 250 -100 = 150 Tons

Cost of per permit per ton : $2500

Annual Cost of option C for the first Year = $2500 × 150 = $375,000

As annual increase in expense are 10% and the company uses same discount rate for computing present value.

Present value of annual cost for each year is $375,000

So present value of total cost for Option C = $375,000*5 = $1,875,000