Answer:

Therefore the bank need to offer 23.6% annual interest rate compounded twice.

Explanation:

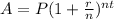

Compound interest formula:

A=Amount

P=Principal

r=rate of interest

n= Number of times interest is compounded per year.

t= time

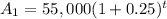

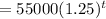

Bank A

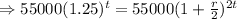

P=$55,000, r=25% = 0.25, n=1, t=t

The amount that the school have to pay after t year is

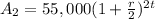

Bank B

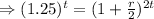

P=$55,000, r=?, n=2, t=t

The amount that the school have to pay after t year is

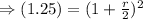

Since the amount for both banks are same.

i.e

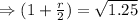

⇒r=0.118×2

⇒r = 0.236

⇒r =23.6%

Therefore the bank need to offer 23.6% annual interest rate compounded twice.