Answer:

a) Calculated value F = 1.088 < 3.29

null hypothesis is accepted

Therefore there is no difference between the variances.

b) t = 8.79 > 1.746 for 16 degrees of freedom at 95% level of significance.

The null hypothesis is rejected.

we do not compare means between the two data sets

c) The 95 % of confidence intervals for the difference between means

are (3.30 ,4.68)

Explanation:

Given data

Data set A Data set B

Total 677.98 Total 574.24,

n₁= 10 n₂=8

mean((x₁⁻) = 67.798 mean( x₂⁻) = 71.78

variance(S₁²) = 0.663084 variance(S₂²)= 0.727143

S.D(S₁) = 0.814299972 S.D(S₂) = 0.8527267191

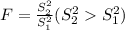

a) Null hypothesis (H₀) : σ₁² = σ₂²

Alternative hypothesis: σ₁² ≠ σ₂²

The compare of variances we will use the test statistic is F - distribution

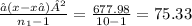

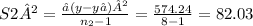

given data total= 677.98

∑(x-x⁻ )² = 677.98

Given data ∑(y-y⁻ )² = 574.24

S₁² =

The degrees of freedom ν = ( n₁-1, n₂-1) = (10-1 ,8-1) = (9 , 7)

Tabulated value of F for (9 , 7) degrees of freedom at 5% level of significance is 3.29 (see 'F' table at 0.05 level )

Conclusion:-

Calculated value F = 1.088 < 3.677

null hypothesis is accepted

Therefore there is no difference between the variances.

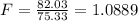

b)

Null hypothesis (H₀) : μ₁ - μ₂≤ D ( given data D= 0.5 add to each data

Alternative hypothesis: μ₁ - μ₂≥ D

Sample statistic :- (x₁⁻ - x₂⁻)

Estimated standard error:-

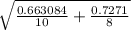

standard error (S. e) =

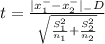

Test statistic 't'

mean((x₁⁻) = 67.798 mean( x₂⁻) = 71.78

variance(S₁²) = 0.663084 variance(S₂²)= 0.727143

S.D(S₁) = 0.814299972 S.D(S₂) = 0.8527267191

standard error (S. e) =

= 0.396

= 0.396

Now the test statistic

t = 8.79

The degrees of freedom of t- distribution is

ν= n₁+ n₂-2 = 10 +8-2=16

tabulated value = 1.746 for 16 degrees of freedom at 95% level of significance.

Conclusion:-

The null hypothesis is rejected.

we do not compare means between the two data sets

C) 95% of confidence interval for the difference between means

Solution:-

|(x₁⁻ - x₂⁻)| ± tₐ S. e ( (x₁⁻ - x₂⁻)

where standard error (S. e) =

given data

mean((x₁⁻) = 67.798 mean( x₂⁻) = 71.78

variance(S₁²) = 0.663084 variance(S₂²)= 0.727143

S.D(S₁) = 0.814299972 S.D(S₂) = 0.8527267191

Standard error =

= 0.396

= 0.396

Standard error = 0.396

The degrees of freedom of t- distribution is

ν= n₁+ n₂-2 = 10 +8-2=16

tabulated value = 1.746 for 16 degrees of freedom at 95% level of significance.

The confidence intervals are

( |(x₁⁻ - x₂⁻)| - tₐ S. e ( (x₁⁻ - x₂⁻), |(x₁⁻ - x₂⁻)| + tₐ S. e ( (x₁⁻ - x₂⁻))

now substitute all values , we get

(|67.798-71.78|-1.746 X (0.396),(|67.798-71.78|+1.746 X (0.396))

on calculation we get

(3.98-0.691 ,3.98+0.691 )

(3.30 ,4.68)

The 95 % of confidence intervals for the difference between means

are (3.30 ,4.68)