Answer:

d. 1.46

Explanation:

The question is incomplete:

Below are the stock returns for the past five years for Agnew

Industries:

Year Stock Return

2002 22%

2001 33 %

2000 1 %

1999 -12 %

1998 10%

The coefficient of variation (CV) can be expressed as the coefficient between the standard deviation over the mean of the stock returns:

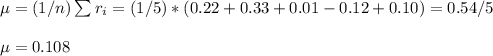

The mean of the stock returns is:

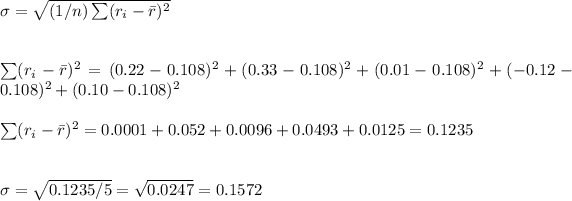

The standard deviation is:

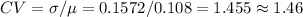

Then, the coefficient of variation is: