Answer:

The past service cost included n the net pension is $600

Step-by-step explanation:

Given Data;

Increase in present Service Cost (PSC)-vested employees = $5,000

Increase in present Service Cost (PSC)-non-vested employees= $2,000

Remaining vesting period- non-vested employees =5 years

Remaining working life-vested employees =10 years

Remaining working life-non-vested employees = 20 years

To calculate the past service cost in the net pension expense under U.S GAAP; we use the formula given as;

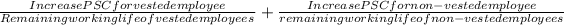

Past service cost =

Substituting into the equation, we have;

Past service cost = $5,000/10 + $2,000/20

=$500 + $100

= $600

The past service cost included n the net pension is $600