Answer:

P = $1664.12 pay with 9% compounded monthly

P = 1652.98 pay with 9% compounded continuously

Step-by-step explanation:

given data

time period = 20 year

amount = $10000

solution

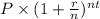

we get here compound interest for 9% compounded monthly that is express as

FV =

.................1

.................1

here P is principal amount and r is interest rate and n compound in year and FV is future value

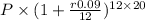

$10000 =

solve it we get

P = $1664.12 pay with 9% compounded monthly

and

for 9% compounded continuously

FV =

............2

............2

$10000 = P\times e^{0.09\times 20}

solve it we get

P = 1652.98 pay with 9% compounded continuously