Answer:

The after-tax weighted average cost of capital for Ronnie's Commics is 9.6%

Step-by-step explanation:

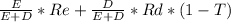

WACC is calculated by the formula

=

According to the information given in the question,

E+D= $250,000,000 + $750,000,000 = $1,000,000,000

E = $250,000,000

D = $750,000,000

T = 35%

Re = 15%

Rd = 12%

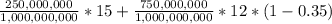

Substituting the values in the formula,

=

= 3.75 + 5.85 = 9.6%