Solution and Explanation:

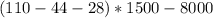

The yYearly Equal Cash Inflows =

= 46000

= 46000

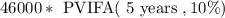

Present Value of Inflows at the rate of 10% =

= 46000 multiply with 3.791 = 174386

= 46000 multiply with 3.791 = 174386

NPV = 174386 minus 132500 = 42386

Briggs must make an investment in the project as it generates additional wealth and NPV is positive

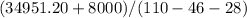

For NPV = 0, PV of inflows = 132500

PV Of Inflows = Annual Cash Flow multiply with 3.791

Annual Cash Flow = 132500 divide by 3.791 = 34951.20

So, Hours =

= 1193.08 hours

= 1193.08 hours