Answer:

Total $986.2534

Step-by-step explanation:

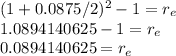

We have to discount the annual bond against the same rate but compounding semiannualy

Now we discount the 12 coupon payment and the maturity at the given discount rate

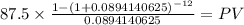

C 87.500 (1,000 x 0.0875)

time 12

rate 0.0894140625

PV $628.4172

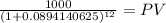

Maturity 1,000.00

time 12.00

rate 0.0894140625

PV 357.84

PV c $628.4172

PV m $357.8362

Total $986.2534