Answer:

Step-by-step explanation:

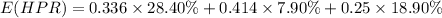

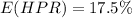

The expected return is the weighted average of the expected returns in each scenario by its respective probability.

The distribution of the holding period returns (HPR) under three different scenarios is:

State of the economy Scenario #(s) Probability, p(s) HPR

HPR Boom 1 0.336 28.40%

Normal growth 2 0.414 7.90%

Recession 3 0.25 18.90%

The calculations are: