Answer:

1. 13.33 years

2. 11 years

3. 186 years

Step-by-step explanation:

Problem 1. Perry has an opportunity to invest with an APR of 5.25%.

Using the rule of 70, how long will it take his investment to double? (Round to the hundredths.)

Solution

The rule of 70 permits to make a quick estimation of the number of years an investment would double its value, depending on the annual percentage rate (APR).

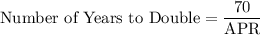

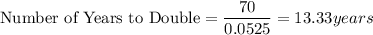

The formula used for the rule of 70 is:

Substitute with APR = 5.25 and compute:

Problem 2. If you had a bank that offered 6.1% interest and compounded money 4 times a year, how many years would go by until you could turn $6000 into enough to buy a brand new car ($12,000)?

For this problem, you will want to guess and check until you find the right solution.

Solution

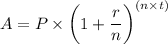

You have to use the formula for monthly compound interest:

Where:

- A is the the value after adding the interests: $12,000

- P is the value invested: $6,000

- r is the APR: 6.1% = 0.061

- n is the number of times the interest is compounded per year: 4

- t is the number of years: your unknown

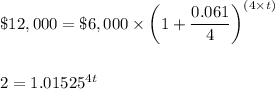

Substitute:

Guess and check until you find the right solution:

Your first educated guess may be using the rule of 70.

- Number of years = 70/6.1 = 11.48

Use t = 12 ⇒ 4t = 4(12) = 48

- 1.01525⁴⁸ = 2.067 . . . pretty close to 2

Use t = 11 to verify which is closer to 2:

t = 11 is closer because 2 - 1.946 = 0.054 and 2.067 - 2 = 0.067

Hence, the best calculation is 11 years.

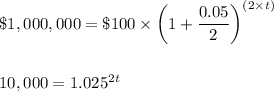

Problem 3. How many years does it take for $100 to reach $1 million dollars? The rate is at 5% with it being compounded twice a year. Round to a whole year. Hint: You may want to start with numbers above 100 years!

Solution

Use the same formula for monthly compound interest:

With:

- A: $100

- P: $1,000,000

- r: 5% = 0.05

- n: 2

- t: your unknown

Substitute:

Guess and check until you find the right solution.

Start with t = 100 years:

- 1.025²⁰⁰ ≈ 140 . . . very far from 10,000

Try t = 200 years:

t = 150

t = 186

t = 187

9,756 is closer to 10,000 than 10,250, thus the answer is 186 years.