Answer:

Stock D as their expected return matches the Capital Assets Price Models

Step-by-step explanation:

We have to calcualte the CAPM for each stock and look which matches with the expected rate of return:

risk free = 0.04

market rate = 0.1

premium market = (market rate - risk free) 0.06

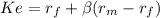

Stock A

beta(non diversifiable risk) = 0.85

Ke 0.09100 = 9.1%

Expected return: 7% it would prefer to sale

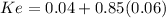

Stock B

beta(non diversifiable risk) = 0.75

Ke 0.08500 = 8.5%

Expected return: 9% it would prefer to purchase as it offer more

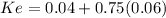

Stock C

beta(non diversifiable risk) = 1.2

Ke 0.11200 = 11.20%

Expected return: 9.5% it would prefer to sale

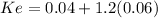

Stock D

beta(non diversifiable risk) = 1.35

Ke 0.12100 = 12.1%

Expected return: 12.1% Indifferent as it is mathces the CAMP the stock is neither overperforming nor underperforming

Stock E

beta(non diversifiable risk) = 0.5

Ke 0.07000 = 7%

Return = 14% It would prefer to purchase as it offer more