Answer:

Price willing to pay=$1105.94

Step-by-step explanation:

Annual Coupon Payment=$1,000*0.08

Annual Coupon Payment=$80

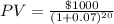

Calculating Present Value (PV) of Par Value:

Where:

i is the rate of return.

FV is par value

PV= $258.419.

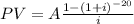

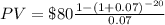

Calculating PV of annual Coupon Payment:

i is the coupon rate

A is the annual Payment

PV=$847.521

Price willing to pay= Present Value (PV) of Par Value+ PV of annual Coupon Payment

Price willing to pay=$258.419+$847.521

Price willing to pay=$1105.94