Answer:

a. $425,678.

b. 20 years

c. net present value, bond yields, spot rates, and pension obligations.

Step-by-step explanation:

a.

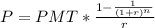

In order to find the present value we have to apply in the following formula

where

P = Present value of an annuity stream

PMT = Dollar amount of each annuity payment

r = Interest rate (also known as discount rate)

n = Number of periods in which payments will be made

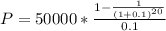

Replacing values we have that

P = $425,678

b.

As written in the exercise, 20 years for a present value of $425,678

c.

The package of bonds can include net present value, bond yields, spot rates, and pension obligations.