Given:

Net sales = $400000

Cost of goods sold = $200,000

Operating expenses = $100,000

Interest expenses = $50,000

To find:

The operating profit margin

Solution:

To calculate the operating profit margin, first we have to find the operating profit.

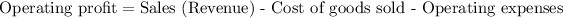

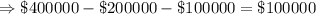

Subtract your total operating expenses from gross profit to calculate operating profit.

That is,

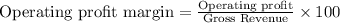

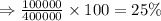

Divide operating profit by gross revenue to calculate operating profit margin.

Therefore, the Operating profit margin is 25%.