Answer:

- The cash flow stream from investment X has higher present value than the the cash flow stream from investm Y.

Step-by-step explanation:

1. Present value of investment X

- Annual payment: C = $4,200

- Number of years: t = 8

- Rate: r = 5%

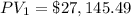

- PV₁ = ?

Formula:

![PV=C* [(1)/(r)-(1)/(r(1+r)^t)]](https://img.qammunity.org/2021/formulas/business/college/7lql8xe5fktxq5lruzdjmpcnrkm5zyx5bq.png)

Substitute and compute:

![PV_1=\$ 4,200* [(1)/(0.05)-(1)/(0.05(1+0.05)^8)]](https://img.qammunity.org/2021/formulas/business/college/oowr6knysabanb5m0fw2u2aoaxntkmkcqf.png)

2. Present value of investment Y

- Annual payment: C = $6,100

- Number of years: t = 5

- Rate: r = 5%

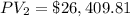

Formula:

![PV=C* [(1)/(r)-(1)/(r(1+r)^t)]](https://img.qammunity.org/2021/formulas/business/college/7lql8xe5fktxq5lruzdjmpcnrkm5zyx5bq.png)

Substitute and compute:

![PV_2=\$ 6,200* [(1)/(0.05)-(1)/(0.05(1+0.05)^5)]](https://img.qammunity.org/2021/formulas/business/college/1cfc1i9bb5u7o4z9fbz5ovb1dnu86u6kry.png)

Hence, the cash flow stream from investment X has higher present value than the the cash flow stream from investm Y.