Answer:

- 1. First blank: $6,436.98

- 2. Second blank: $1,677.15

Step-by-step explanation:

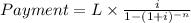

The equation to calculate the monthly payments of a loan is:

Where,

- L is the amount of the loan.

- i is the interest rate per period and is calculated dividing the yearly percent rate by 100 and by the number of periods in a year = 0.09/12 = 0.0075

- n is the total number of periods and is calculated as the product of the number of periods in a year times the number of years (different for each of the options given)

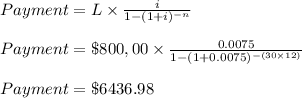

Quesiton 1. Mortgage payment for a stardard 30-year mortgage.

- Answer: $6,436.98 ← answer

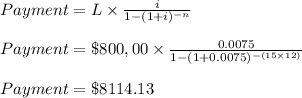

Question 2. Difference in the monthly payment

Difference in the monthly payment of the 15-year mortgage and 30-year mortgage will be $8,114.13 - $6,436.98 = $1,677.15 ← answer

Question 3. How much more interest will you pay over the life of the loan if you take out a 30-year mortage instead of a 15-year mortgage?

i. Interest over the life of the 30-years mortgage

- Interest = Total payment - loan amount

- Total payment = $6436.9 × 30 × 12 = $2,317,312.80

- Interest = $2,317,312.80 - $800,000.00 = $1,517,312.80

ii) Interest over the life of the 15-years mortgage

- Total payment = $8,114.13 × 15 × 12 = $1,460,543.40

- Interest = $1,460,543.40 - $800,000,.00 = $660,543.40

iii) Difference = $1,517,312.80 - $660,543.40 = $856,769.40

That is the option b. $856,769.40 ← answer