Answer:

And we can find this probability using the normal standard distribution table or excel and we got:

Step-by-step explanation:

Previous concepts

Normal distribution, is a "probability distribution that is symmetric about the mean, showing that data near the mean are more frequent in occurrence than data far from the mean".

The Z-score is "a numerical measurement used in statistics of a value's relationship to the mean (average) of a group of values, measured in terms of standard deviations from the mean".

Solution to the problem

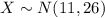

Let X the random variable that represent the expected return, and for this case we know the distribution for X is given by:

Where

and

and

We are interested on this probability

And the best way to solve this problem is using the normal standard distribution and the z score given by:

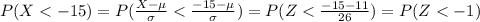

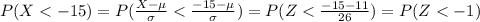

If we apply this formula to our probability we got this:

And we can find this probability using the normal standard distribution table or excel and we got: