Answer:

correct option is d. 553,000

Step-by-step explanation:

given data

expected salary = $40,000

steady rate = 4% per year

time = 25 year

discount rate = 9%

solution

we use here formula for present in tvm growing annuity problem is

present value = expected salary ÷ ( discount rate- steady rate ) - [ {expected salary × (1+steady rate)^time) ÷ ( discount rate- steady rate ) } ÷ ( 1+discount rate)^time)] .................1

put here value we get

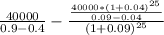

present value =

present value = $552,679 nearly by = $553,000

so correct option is d. 553,000